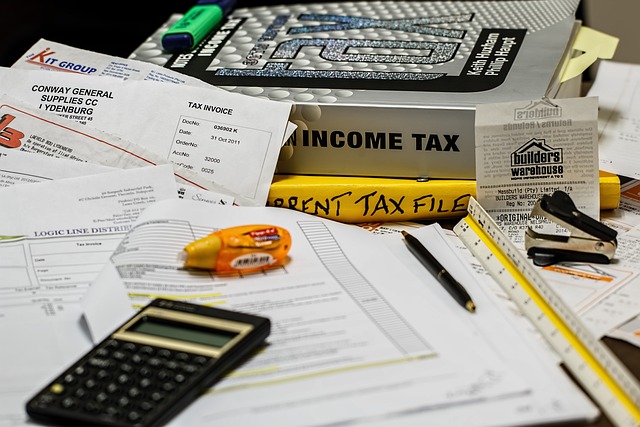

- Tax Planning and Compliance: We offer comprehensive tax planning services,

helping individuals and businesses develop effective strategies to minimize

tax liabilities while ensuring compliance with applicable laws and regulations.

Our experts analyse your financial situation, assess deductions and credits,

and identify opportunities to optimize your tax position.

- Income Tax Return Preparation: Our skilled professionals specialize in

preparing accurate and timely income tax returns for individuals, businesses,

and other entities. We stay informed about the latest tax forms, deductions,

and credits, ensuring that your returns are completed efficiently and

accurately, maximizing your eligible refunds or minimizing potential tax

liabilities.

-

Tax Advisory and Consulting: Whether you have complex income tax issues

or need guidance on specific transactions, our tax consultants are here to

help. We provide expert advice on various income tax matters, such as

investment planning, capital gains, tax implications of business decisions, and

compliance with changing tax laws.

-

Tax Dispute Resolution: If you are facing an income tax audit or dispute, our

consultancy can assist you. We have experience in handling tax audits,

responding to inquiries from tax authorities, and negotiating settlements. Our

goal is to protect your rights, minimize penalties, and ensure a fair resolution

to any tax-related disputes.

- PAN Card: We assists our client for registration of New Pan Card for

Individuals, HUF, Association of Persons, Company. Changes or correction in

Pan Card